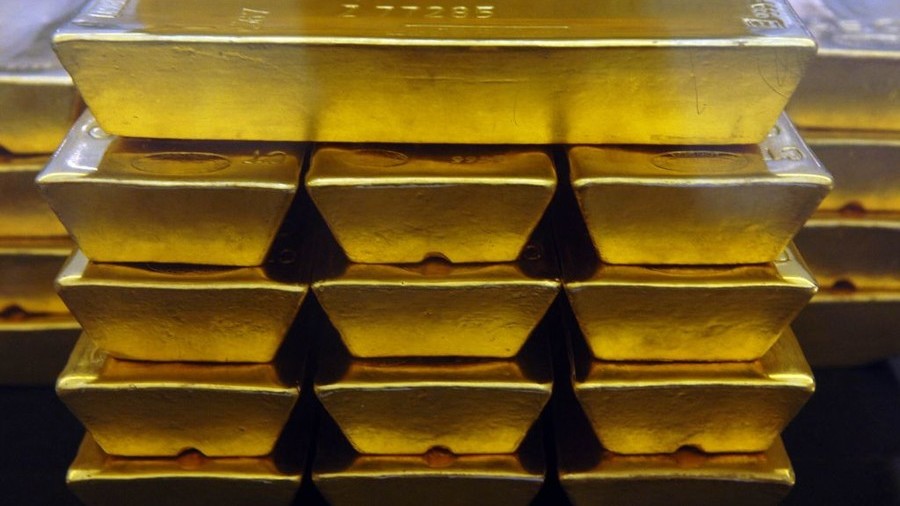

The Bank of England holds an untold number of gold bars in its vaults on behalf of 70 central banks in the world. As a well-known custodian of gold and a reputable one at that, it should be easy for the central bank to deliver the gold it has in storage to its owners when they need it. It should be a logistical issue and maybe a couple of verification. The bank has been doing these kinds of shipments for hundreds of years. The question on everybody’s mind has now been why? Shouldn’t this make other countries weary of putting their gold in the bank.

This has been a widely publicised matter that has raised some concerns and questions that deserve some answers.

So what is the issue? According to Reuters, Venezuela which has been fearing sanctions, the country is attempting to repatriate 14 tonnes of gold it had stored with the Bank of England. They made the request to the bank about two months ago. According g to some unnamed sources, the bank has not been able to process the withdrawal due to insurance issues. The bank also feels that it should know what Venezuela plans to do to with the gold when it receives it. On the 7th of November the Times of London picked the Reuters story and ran a report that stated that British Officials wanted clarification and insisting that Venezuela should meet certain standards to prevent Money laundering. So far, this story has been based on snippets found here and there, including from the federal reserve, the treasury, Reuters and The Times. This also comes a few days after the US had signed an executive order imposing sanctions on the country’s gold industry. This order also puts pressure on the world not to do business with Venezuela.

This is the last thing the government of Venezuela needs and it might even sound unfair for the people of Venezuela who are just victims of a bad government and bad economic policies. What the government of Venezuela wants to do with its gold is its own business, but there have been speculation about the gold at the Bank of England. One is reminded of when Hjalmar Schacht, interwar President of Germany’s Reichsbank who was at the centre of the scandalous Bank of International Settlements, and the centre of a web that was woven to overthrow King Farouk. This sounds a lot like the story of Schacht’s visit to New York in 1928 where he is said to have asked the then governor of the bank, Benjamin Strong to see the Reichsbank’s gold only to find the gold missing or used for other purposes. It didn’t cause an international incident because Schacht reportedly told the New York federal bank governor that he knew that he was “good for it”. Wink. It smelt of a conspiracy. No one knows what happened to the gold, but speculation is that the disappearance of the gold gave Schacht some leverage which could have been the reason that he got such a light sentence at the Nuremberg trial and he re-emerged as a behind-the-scenes fixer after the second world war. So is the gold even there? Should we buy the story about insurance and money laundering concerns?

Maybe the gold isn’t there and the bank is simply trying to buy more time to return the gold it might have misappropriated. The situation is currently unclear and with the reserve bank in both countries not coming up with the same believable story, it has given conspiracy theorists to come up with all sorts of nefarious stories.

This article was brought to you by the Brisbane Gold Company.